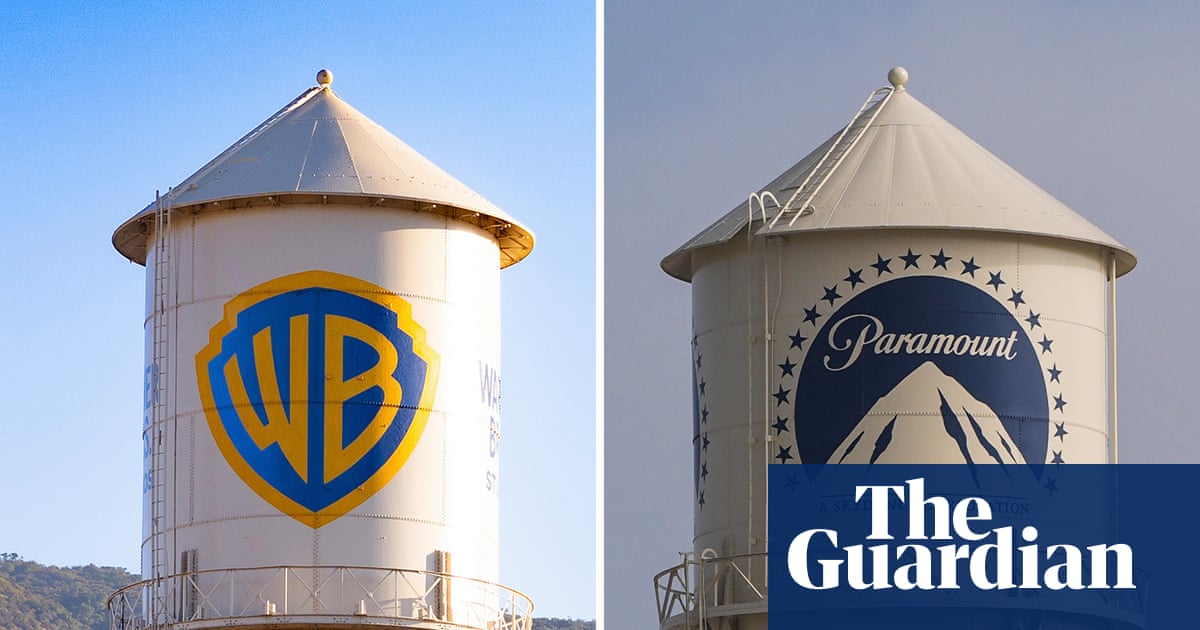

Warner Bros Discovery tells investors to reject ‘inadequate’ $108bn Paramount bid

AI Summary

Warner Bros Discovery (WBD) is urging shareholders to reject Paramount Skydance's $108.4 billion takeover bid, deeming it "inadequate" despite a $40 billion guarantee from Oracle co-founder Larry Ellison. Paramount is attempting to disrupt WBD's $82.7 billion deal with Netflix, where Netflix aims to acquire WBD's movie studios, HBO cable network and HBO Max streaming service, by offering to buy the entire company, including CNN and Discovery Channel. WBD cites significant risks and costs associated with the Paramount offer, including a potential $4.7 billion in expenses like a $2.8 billion breakup fee to Netflix. WBD also claims the Paramount offer is the "largest LBO in history" and poses risks to the offer. Both the Netflix deal and Paramount's bid are expected to face regulatory scrutiny, with concerns raised by lawmakers and industry figures.

Key Entities & Roles

Keywords

Sentiment Analysis

Source Transparency

This article was automatically classified using rule-based analysis. The political bias score ranges from -1 (far left) to +1 (far right).

Topic Connections

Explore how the topics in this article connect to other news stories